I still remember the frustration and disappointment of watching my trading account dwindle by $30 due to a hasty decision. It was a harsh lesson, but it marked the beginning of my journey towards becoming a successful trader.

With the support of XM broker, I was able to turn my fortunes around, eventually booking a substantial profit of $1,500. This transformation wasn’t overnight; it required persistence, learning from mistakes, and leveraging the resources provided by XM.

My experience with XM was a turning point in my trading career. By sharing my story, I hope to inspire and guide others who are navigating the challenges of trading, highlighting the importance of the right broker and a well-thought-out trading strategy.

Key Takeaways

- Transforming initial trading losses into substantial profits is possible with the right guidance and resources.

- XM’s platform and customer service played a crucial role in my trading comeback.

- Learning from mistakes and adapting trading strategies is key to achieving success.

- The importance of choosing a reliable broker like XM for a successful trading experience.

- Developing a successful trading approach requires patience, persistence, and the right tools.

My Early Trading Struggles

My journey into trading began with a harsh lesson that would shape my future decisions. As a beginner, I was prone to making mistakes that would later become valuable learning experiences. In this section, I’ll share my early trading struggles, highlighting the challenges I faced and how they contributed to my growth as a trader.

The $30 Loss That Changed Everything

My first significant loss was a mere $30, but it represented a substantial percentage of my initial investment. This loss had a profound emotional impact, forcing me to reevaluate my approach to the market. I realized that my decisions were not based on sound analysis but rather on intuition and emotions. This experience taught me the importance of managing losses and being cautious with my account balance.

Common Mistakes I Made as a Beginner

As a novice trader, I made several common mistakes, including poor risk management and emotional trading decisions. I often overtraded and chased losses, creating a negative spiral that nearly led me to quit trading altogether. However, this experience ultimately became the foundation for my later success. I learned to develop discipline and a structured approach to trading, which helped me achieve consistent profits in my account over time.

By understanding these early mistakes, I was able to refine my strategy and improve my trading experience. This transformation was crucial in my journey from losing money to making a profit.

What is XM Broker?

With a rich history dating back to 2009, XM has grown into a reputable broker with a global presence, serving over 5 million clients from 190 countries worldwide. The company has built a strong reputation in the forex and CFD markets through consistent service quality and transparent trading conditions.

Company Background and Reputation

XM is a globally recognized broker established in 2009. The company has consistently expanded its product offerings, service, and market presence, earning multiple awards for its platforms, customer service, and trading conditions. XM’s commitment to regulation, transparency, and clients protection has contributed to its solid reputation in the industry.

Regulatory Framework and Security

XM operates under a comprehensive regulatory framework, with oversight from reputable bodies such as CySEC (Cyprus), ASIC (Australia), and FSC (Belize). This multi-layered regulation provides enhanced security for traders‘ funds. Client funds are held in segregated accounts, separate from the company’s operating funds, ensuring they are protected even if the company faces financial difficulties. For a detailed review of XM’s features and service, you can visit FXStreet’s XM review, which provides an in-depth analysis of the broker‘s offerings and website functionality, including account management and trading capabilities.

Why I Chose XM for My Trading Reality Check

After experiencing significant losses in my early trading days, I embarked on a journey to find a reliable broker that could help me turn my trading fortunes around. My search led me to compare various brokers, evaluating their features, costs, and reliability.

Comparing XM to Other Brokers I Tried

In my comparison, XM stood out due to its low minimum deposit requirement of just $5, making it highly accessible to beginners. Unlike other brokers I considered, XM’s transparent fee structure with no hidden charges was a significant factor in my decision.

I was also impressed by XM’s customer service, which was responsive to my initial inquiries, providing me with the confidence that I would receive support when needed. The variety of account types offered by XM allowed me to select one that perfectly matched my trading style and risk tolerance.

Key Features That Attracted Me

The trading platforms provided by XM were robust and user-friendly, catering to my needs as a trader. With over 1,000 trading instruments across various asset classes, XM offered ample opportunities for portfolio diversification.

XM’s comprehensive educational resources played a significant role in my decision, as I needed to improve my trading knowledge after my early failures. The customer service and support provided by XM were crucial in enhancing my trading experience and helping me manage my account effectively.

Overall, XM’s combination of low costs, robust platforms, and excellent customer service made it the ideal broker for my trading needs, allowing me to focus on improving my trading skills and managing my account efficiently.

XM Trading Platforms and Tools

XM offers a robust trading environment through its platforms and tools, catering to the diverse needs of traders. The company’s commitment to providing a superior trading experience is evident in its offerings.

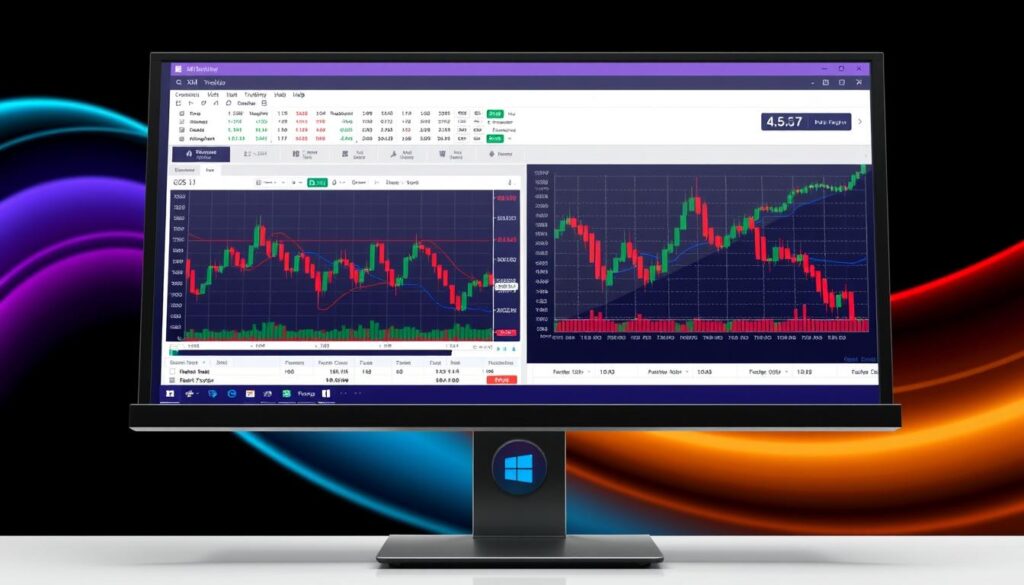

MetaTrader4 and 5 Experience

The MetaTrader4 and MetaTrader5 desktop platforms are industry standards for trading, offering advanced charting tools and automated trading through Expert Advisors (EAs). These platforms support multiple timeframes and order types, making them ideal for experienced traders who require a high level of control and functionality.

The customization options on MT4 and MT5 enable traders to create a tailored trading environment, enhancing their trading efficiency. The Expert Advisors feature automates certain aspects of trading, saving time and reducing emotional decision-making.

Mobile Trading Capabilities

XM’s mobile trading platform is available on both iOS and Android devices, providing a seamless trading experience on the go. This allows traders to monitor the market and manage their positions from anywhere, giving them greater flexibility and control over their trading.

The synchronization between desktop and mobile platforms ensures that traders never miss important market movements or trading opportunities, regardless of their location. This flexibility is crucial for traders who need to stay connected to the market and adjust their strategies accordingly.

Account Types and My Selection Process

XM’s array of account options allowed me to select the one that best suited my trading goals and risk tolerance. When choosing an account type, it’s essential to consider your trading experience, financial goals, and risk management strategies.

Micro vs. Standard vs. XM Zero Accounts

The Micro account is ideal for beginners or those who want to trade with minimal risk, allowing for micro-lots (1,000 units of the base currency) with a minimum deposit of just $5. In contrast, the Standard account is more suited for traders who are looking for more flexibility in their trading conditions. XM Zero accounts offer tight spreads with a commission, making them suitable for experienced traders who trade high volumes.

Each account type has its benefits and is designed to cater to different trading styles and financial goals. For instance, the Micro account’s low-risk entry was invaluable during my early trading days, enabling me to practice without significant exposure.

Why I Selected My Specific Account Type

I initially chose the Micro account due to its low minimum deposit requirement and the ability to trade with micro-lots, which helped me rebuild my confidence. As my trading skills improved, I upgraded to a Standard account, which offered more flexibility in terms of leverage and spreads.

My account selection process involved careful consideration of my trading volume, preferred instruments, and risk tolerance. Understanding the costs associated with each account type, including fees and commission structures, was crucial in making an informed decision.

Trading Instruments and Markets at XM

XM’s trading platform boasts an impressive selection of over 1,000 trading instruments, enabling traders to access a wide range of financial markets from a single account. This diversity allows traders to find the perfect instruments that match their trading style.

Forex, Stocks, and Commodities Options

The platform offers a vast selection of forex pairs, including major, minor, and exotic pairs. Traders can trade over 55 currency pairs, such as EUR/USD and GBP/USD, which are known for their liquidity and tighter spreads. Additionally, XM provides access to commodities like gold, silver, crude oil, and natural gas, allowing for portfolio diversification. Investors can also trade in stocks from leading companies across the US, Europe, and Asia, providing exposure to individual company performance without needing to own the actual shares.

The Instruments That Helped Me Turn Profit

During my trading journey, I found that certain instruments were more profitable than others. I focused on major forex pairs like EUR/USD and GBP/USD due to their liquidity. The commodities market, especially gold and silver, became a crucial part of my portfolio as I discovered their unique price movement patterns. I also utilized stock CFDs to capitalize on company performance without owning the shares. Diversifying across different markets helped me reduce risk and find consistent trading opportunities throughout various market conditions.

Fees, Spreads, and Costs Analysis

The clarity of XM’s fee structure was a game-changer for my trading strategy. As I transitioned from losses to profits, understanding the intricacies of XM’s fees, spreads, and associated costs became crucial.

Understanding XM’s Fee Structure

XM’s fee structure is designed to be transparent and competitive, catering to traders of all levels. One of the significant advantages is that XM does not charge any deposit fees, allowing traders to fund their accounts without additional costs. Furthermore, XM offers fee-free withdrawals, regardless of the amount or method. The spreads are competitive, starting from as low as 0.6 pips on major currency pairs with no hidden markups.

XM’s complete fee structure includes spreads, commissions, overnight fees (swaps), and other costs that can impact trading profitability. Different account types offer varying spread structures, making it essential to understand the relationship between the account type and trading costs.

How I Minimized Costs to Maximize Profits

To minimize trading costs, I employed several strategies. First, I selected the right account type based on my trading volume, which helped reduce costs associated with spreads and commissions. I also focused on instruments with tighter spreads, further minimizing my trading costs.

The absence of deposit and withdrawal fees at XM was a significant advantage, allowing me to retain more of my profits. Additionally, I factored in overnight holding costs (swaps) into my trading decisions, especially for positions held over multiple days. By calculating the total cost per trade, I was able to set more accurate profit targets and stop-loss levels, significantly improving my overall profitability.

My Trading Strategy Evolution with XM

With XM, I learned to adapt and evolve my trading strategy to achieve consistent results. My journey was not straightforward; it involved significant learning and adjustments along the way.

Initial Flaws in My Trading Strategy

Initially, my trading strategy was flawed, leading to consistent losses. I relied heavily on indicators without fully understanding their limitations. This overreliance resulted in poorly informed trading decisions, often contrary to market conditions. I recall a particular instance where my failure to adjust my strategy according to market volatility led to a significant loss.

As I reflected on my approach, I realized the need for a more structured method that combined technical indicators with fundamental analysis and proper risk management. This realization marked the beginning of a significant shift in my trading strategy.

A Profitable Approach After Learning

After learning from my initial mistakes, I developed a more robust trading strategy. I started maintaining a trading journal to track my trades, identifying patterns in both successful and unsuccessful trades over time. This practice helped me refine my strategy, incorporating specific entry and exit rules, position sizing based on risk percentage, and strict adherence to stop-loss orders.

I also learned to adapt my strategy to different market conditions, rather than applying a one-size-fits-all approach. The knowledge gained from XM’s educational resources was invaluable, particularly in understanding market correlations and interpreting economic news events. As I honed my skills, I found that successful trading wasn’t about finding a “holy grail” strategy but developing a consistent approach that aligned with my personality and risk tolerance.

| Strategy Component | Initial Approach | Evolved Approach |

|---|---|---|

| Market Analysis | Overreliance on indicators | Combination of technical and fundamental analysis |

| Risk Management | Lack of clear risk management | Strict adherence to stop-loss orders and position sizing |

| Adaptability | Fixed strategy regardless of market conditions | Adaptive strategy based on market volatility and conditions |

As I look back, it’s clear that my experience with XM was pivotal in my trading journey. The evolution of my trading strategy was a result of continuous learning and adaptation, ultimately leading to a more profitable and sustainable approach.

From Loss to Profit: My XM Story

From losses to profits, my XM story is one of resilience and strategic decision-making. As a trader, I’ve experienced my fair share of ups and downs, but with XM, I was able to turn my trading experience around.

The Turning Point in My Trading Journey

The turning point came when I started attending XM’s live education sessions. I never missed these sessions, even if some topics didn’t directly interest me, as I knew there was always something valuable to take away. One of the key advantages I gained was the narrow spreads on major currency pairs, which significantly impacted my trading experience. For the majors, the spreads were so narrow that I often forgot they existed, allowing me to focus on making profitable trades without worrying about the cost of opening or closing a position.

This was a crucial time in my journey as a trader, as it allowed me to refine my strategy and make better decisions. I was able to grow my account from its lowest point to achieving a $1,500 profit milestone.

Key Decisions That Led to $1,500 Profit

Several key decisions contributed to my success. First, I adjusted my risk management strategy by limiting my position sizes to protect my capital while still allowing for meaningful profit. I also focused on quality trades rather than quantity and stuck with instruments I thoroughly understood. Additionally, I utilized XM’s narrow spreads on major currency pairs to maximize my money management. By making these adjustments over time, I was able to turn my account around and achieve significant profit.

My experience demonstrates that recovering from trading losses is possible with the right broker, proper education, and a disciplined approach to the markets. By leveraging XM’s resources and refining my strategy, I was able to achieve a substantial profit and become a more confident trader.

XM Educational Resources and How They Helped

One of the key factors that contributed to my trading success was XM’s comprehensive educational content. As a novice trader, I was looking for a broker that not only offered good trading conditions but also invested in trader education. XM stood out in this regard, providing a wide range of educational resources that catered to different levels of traders.

Webinars and Training Materials I Used

I regularly attended XM’s live webinars, which were hosted by experienced traders. These sessions provided actionable insights into trading strategies, particularly in technical analysis and risk management. The materials provided, including video tutorials and written guides, were invaluable in helping me understand complex concepts.

The structured approach to education allowed me to progress from basic to advanced trading strategies. I also benefited from the economic calendar and market analysis tools, which helped me understand fundamental factors affecting the markets.

How Education Improved My Trading Results

By leveraging XM’s educational resources, I was able to improve my trading results significantly over time. The combination of theoretical knowledge and practical application was key to my development as a trader. Participating in XM’s trading competitions also gave me hands-on experience in a risk-free environment.

Even as I continue to gain experience, I still rely on XM’s resources to refine my strategies and stay updated on market developments. This ongoing education has been crucial in maintaining my competitive edge in the markets.

Customer Support Experience with XM

With XM, I’ve discovered that exceptional customer support is crucial for a successful trading experience. XM excels in providing responsive and multilingual assistance to its clients, offering 24/5 support during all trading hours.

Response Times and Issue Resolution

XM’s customer support is accessible through various channels, including live chat, email, and telephone. The live chat feature stands out for its quick response times, typically under a minute, making it ideal for urgent inquiries. Email support is also efficient, with responses usually within 24 hours.

The average response time for email inquiries was impressively fast, typically within a few hours, which is significantly better than many other brokers I’ve used.

How Support Helped During Critical Trades

During a critical technical issue while making an important trade, XM’s support team provided a quick response that prevented potential losses. The multilingual support team, available in over 30 languages, ensures that traders worldwide can communicate effectively without language barriers.

The professionalism and knowledge level of XM’s customer service representatives demonstrated the broker’s commitment to client satisfaction, significantly contributing to my positive trading experience.

Conclusion: Lessons Learned and Future Trading Plans

XM has proven to be a reliable broker, helping me turn losses into profits. Through my journey, I’ve learned invaluable lessons about trading psychology, risk management, and the importance of continuous education.

The key factors that contributed to my trading turnaround include selecting the right broker, developing a structured trading strategy, and utilizing educational resources effectively. I’ve come to understand that successful trading requires patience and discipline rather than seeking quick profits.

Moving forward, I plan to scale my account size gradually while maintaining the same risk management principles that led to my initial success. I’ll continue exploring different instruments and markets available on XM’s platforms, particularly expanding into commodities and stocks to further diversify my trading portfolio.

For traders struggling with losses or inconsistent results, I recommend conducting an honest assessment of their trading process and making necessary adjustments. With the right broker, tools, and mindset, achieving consistent profits is possible for traders willing to put in the time and effort to learn and improve.

I’ll continue to evaluate my trading performance systematically, tracking key metrics like win rate, risk-reward ratio, and maximum drawdown to ensure continued improvement. Effective customer support, including responsive email communication, has been invaluable in clarifying trading conditions and resolving account issues promptly.