The quest for fast cash and financial freedom is a universal one. Many have turned to dropshipping as a means to achieve this goal, but there’s a more lucrative opportunity waiting to be tapped into.

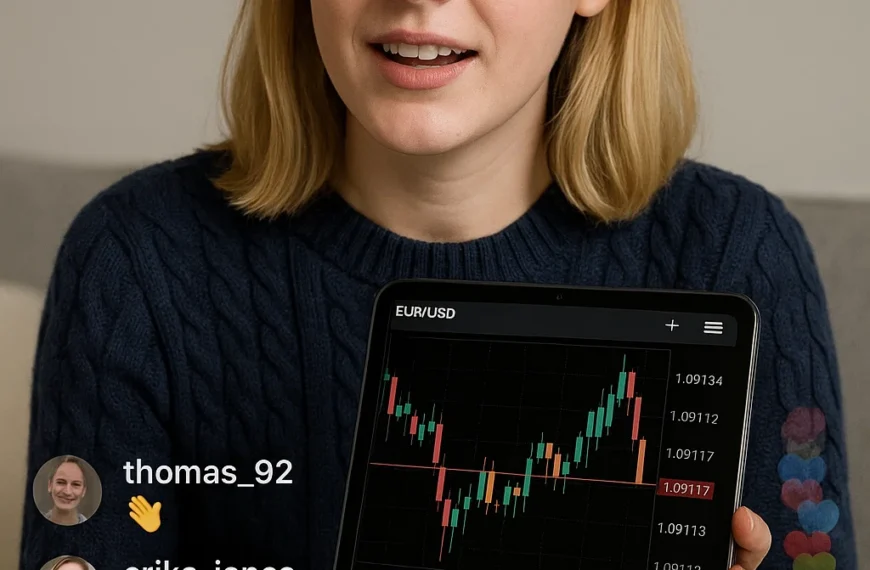

The foreign exchange market, or forex, is the largest financial market in the world, boasting a staggering daily trading volume of over $7.5 trillion. Despite its enormity, it remains largely under the radar for the average investor.

This guide will walk you through how trading can become a legitimate hustle for generating income and building a sustainable financial future. When approached as a serious business, trading can outperform many other online money-making methods.

Key Takeaways

- Discover the potential of the forex market for generating fast cash.

- Learn how to approach trading as a serious business.

- Understand the basics of setting up a trading business framework.

- Explore essential trading strategies for success.

- Uncover the benefits of trading over other online money-making methods.

Why Trading Trumps Dropshipping for Fast Cash

For those seeking rapid financial gains, the choice between dropshipping and trading is crucial. While dropshipping has been a popular e-commerce business model, it comes with significant limitations that hinder the potential for fast cash.

The Limitations of Dropshipping Business Models

Dropshipping is plagued by several fundamental issues, including supply chain dependencies, thin profit margins, and high competition. These challenges mean that entrepreneurs often have to invest considerable time and resources before seeing meaningful returns. The process typically involves months of setup, marketing, and optimization, creating a significant barrier to achieving “fast cash.”

How Trading Offers Quicker Returns on Investment

In contrast, trading markets operate nearly 24/7, allowing for immediate execution and potential profits from day one. The liquidity advantage of trading over physical product businesses is substantial. Unlike stock exchanges with shorter opening hours, currency trading continues around the clock, enabling traders to react to global events in real-time. This flexibility is crucial for capitalizing on market opportunities as they arise.

Real Numbers: Comparing Potential Earnings

When comparing the potential earnings of successful dropshipping operations versus trading accounts of similar investment sizes, the difference is stark. Trading offers multiple avenues for profit, including stocks, forex, and options, providing greater flexibility and opportunity. For instance, a trader can capitalize on market fluctuations to generate income, whereas dropshipping is limited by its business model. Realistic earnings comparisons reveal that trading can offer quicker and more substantial returns on investment.

- Trading allows for immediate execution and potential profits from day one.

- The forex market operates around the clock, offering flexibility for traders.

- Trading provides multiple avenues for profit, including stocks, forex, and options.

Understanding the Trading Landscape

Navigating the world of trading requires a deep understanding of the various markets and instruments available. The trading landscape is diverse, offering numerous opportunities for investors to profit from different market conditions.

The market is influenced by various factors, including geopolitical events, economic indicators, and market sentiment. Understanding these dynamics is crucial for making informed trading decisions.

Forex: The $7.5 Trillion Daily Market Opportunity

Forex trading involves exchanging one currency for another with the aim of making a profit from the exchange rate fluctuations. The forex market is the largest in the world, with a daily trading volume of $7.5 trillion, providing unparalleled liquidity and opportunities for traders.

Stock Trading: Capitalizing on Company Performance

Stock trading involves buying and selling company shares to profit from their price movements. Investors can benefit from both rising and falling stock prices by employing various trading strategies, including long-term investing and short-selling.

Options and Futures: Leveraging Advanced Instruments

Options and futures are advanced trading instruments that offer leverage and specialized strategies for experienced traders. These derivative instruments can be used to amplify returns, hedge existing positions, or generate income through strategies like covered calls.

In conclusion, understanding the trading landscape involves grasping the different markets, including forex, stocks, and derivatives like options and futures. Each market has its unique characteristics, volatility, and potential for returns, allowing traders to choose the ones that best suit their goals and risk tolerance.

Setting Up Your Trading Business Framework

Transforming trading into a dependable income stream necessitates a business-like framework. To achieve this, one must adopt a structured approach that encompasses various critical elements.

Treating Trading Like a Serious Business

Treating trading as a serious business is the foundation of a successful trading framework. This involves developing a disciplined mindset and implementing robust systems to manage your trading activity. By doing so, you can ensure that your trading endeavors are approached with the same level of professionalism as any other business venture.

A key aspect of this is creating a comprehensive business plan that outlines your trading goals, risk tolerance, and strategies for achieving success. This plan should serve as a roadmap, guiding your trading decisions and helping you stay focused on your objectives.

Creating Your Trading Entity and Separate Accounts

Establishing a trading entity, such as an LLC or trust, is crucial for separating personal and trading finances. This not only provides liability protection but also offers potential tax advantages. By creating a dedicated trading entity, you can better manage your trading account and maintain a clear distinction between personal and business finances.

Opening separate accounts for your trading business is also essential. This allows for more effective financial management and ensures that your trading activity is treated as a distinct business operation.

Determining Your Working Capital Strategy

Determining your working capital strategy is vital for managing risk and maximizing potential returns. This involves allocating your trading capital effectively and ensuring that you have sufficient funds to execute your trading strategies. Professional traders never risk their entire capital base on single positions, so it’s essential to develop a capital allocation plan that balances risk and potential reward.

By carefully planning your working capital strategy, you can create a resilient trading portfolio that is better equipped to withstand market fluctuations and achieve long-term success.

Fast Cash, Trading Grind, Real Income Move: Essential Strategies

Consistent profitability in trading isn’t achieved overnight; it demands a robust trading plan, disciplined risk management, and the right income-generating strategies. A comprehensive trading plan is the foundation upon which consistent profitability is built. This involves detailed market analysis methods, clear entry and exit criteria, and performance metrics to evaluate success.

Developing a Robust Trading Plan

Successful traders develop their plans during calm periods, avoiding the heat of market action. This unemotional decision-making process is crucial. A robust plan includes market analysis, entry/exit strategies, and performance metrics. For instance, Mark’s journey and those of his students demonstrate that a well-crafted plan can transform trading into a sustainable, full-time business.

Risk Management: The Key to Sustainable Profits

Effective risk management is what differentiates profitable traders from those who fail. This includes position sizing, stop-loss strategies, and portfolio diversification. By managing risk, traders can protect their capital and ensure sustainable profits over time. For more insights on successful trading strategies, you can refer to real trade recaps.

The Covered Call Strategy for Consistent Income

The covered call strategy is a reliable method for generating consistent income. It involves selling call options on stocks you already own, thereby generating premium income. To implement this strategy effectively, one must understand stock selection criteria, optimal strike price selection, and timing considerations. The goal is to achieve a monthly income stream of 2-4%, which can compound over time.

By combining a robust trading plan, effective risk management, and income-generating strategies like the covered call, traders can create a robust trading system that produces both growth and income. This holistic approach allows traders to adapt to different market conditions, whether bullish, bearish, or sideways, ensuring consistent income regardless of broader market performance.

Tools and Resources for Trading Success

The right tools and resources can make all the difference in your trading journey. With the vast array of options available, it’s essential to identify the ones that best suit your trading needs.

Selecting the Right Trading Platform

Choosing the best trading platform is a critical decision for any trader. When comparing popular trading platforms, consider key criteria such as user interface, execution speed, available markets, fee structures, and analytical capabilities. For beginners, it’s crucial to find a platform that offers a user-friendly interface and robust educational resources.

Essential Market Analysis Tools

To make informed trading decisions, you need access to reliable market analysis tools. Technical indicators, economic calendars, and news aggregators provide the data needed to stay ahead of the market. Understanding the difference between fundamental and technical analysis tools is also vital for maximizing their effectiveness.

Educational Resources to Accelerate Your Learning

Continuous learning is key to trading success. There are numerous educational resources available, including books, courses, YouTube channels, and trading communities. When selecting resources, look for quality information that is free from hype and focuses on providing valuable insights.

By leveraging the right tools and resources, traders can significantly enhance their trading performance. Whether you’re a beginner or an experienced trader, it’s essential to stay updated with the best practices and resources available in the trading community.

Mastering the Trading Psychology

To excel in trading, one must develop a strong mental game, as psychology plays a significant role in decision-making. Many professional traders attribute 80% of their success to their mindset rather than their knowledge of the market. This highlights the importance of understanding and managing one’s psychology to achieve consistent results.

Controlling Emotions During Trades

Emotions can significantly impact trading decisions, often leading to impulsive actions driven by fear or greed. Common emotional traps include FOMO (fear of missing out), revenge trading after losses, and the tendency to cut winners short while letting losers run. To mitigate these risks, traders can employ various techniques such as pre-trade routines, mindfulness practices, and physical state management.

- Pre-trade routines help in setting a calm and focused mindset.

- Mindfulness practices enable traders to stay present and avoid impulsive decisions.

- Physical state management, including exercise and nutrition, supports mental well-being.

Developing Discipline and Patience

Discipline is crucial for sticking to a trading plan, even when emotions suggest otherwise. Successful traders develop iron discipline through consistent application of their strategies. This involves patience and the ability to wait for the right opportunities, rather than acting on impulse. By doing so, traders can improve their overall performance and achieve their financial goals.

Embracing Continuous Improvement (Kaizen)

The concept of Kaizen, or continuous improvement, is vital in trading. It involves making small, incremental changes to one’s strategy and processes over time. By documenting their processes, reviewing their performance, and systematically eliminating weaknesses, traders can enhance their skills and adapt to changing market conditions. This approach helps in achieving long-term success and maintaining a competitive edge.

By mastering trading psychology, traders can make more rational decisions, manage risk effectively, and ultimately achieve their financial objectives. It’s about harnessing the power of one’s mindset to succeed in the market.

Conclusion: Your Path to Trading Success

With the insights gained from this article, you’re ready to embark on a trading journey that can lead to financial freedom. Trading offers several key advantages over dropshipping, including the potential for quicker returns on investment and the ability to build sustainable income streams.

To succeed in trading, it’s essential to treat it as a serious business, complete with a robust trading plan, risk management protocols, and psychological mastery. While trading offers the potential for quick returns, sustainable success requires a long-term approach, not a get-rich-quick scheme.

As you begin your trading journey, remember to start small, focus on education and skill development, and gradually scale up your activities. The most successful traders are those who continuously adapt their strategies to changing market conditions while maintaining strict discipline.

To get started immediately, consider setting up a demo account, developing a basic trading plan, and committing to a structured learning program. With Mark Yegge’s guidance, you can master the art of investing, gain confidence in your financial decisions, and build a legacy of wealth and security. Start your journey today and transform your future one smart decision at a time.