Gold Investment Fever Sweeps Korea as “Big Wins” Become Hot Issue

A powerful gold investment boom is spreading across South Korea. As gold prices show sharp movements, individual investors are flocking to the metal as a safe-haven asset, and social media is filling with posts claiming massive profits, pushing gold back into the spotlight.

Stories of short-term windfall gains are especially fueling the trend. Investors are turning not only to physical gold, but also to ETFs, futures, and overseas CFD platforms, saying that “the combination of exchange rates and gold price movements created exceptional returns.”

The momentum is accelerating online. Keywords such as “gold jackpot” dominate community boards, while newcomers flood in with questions about optimal strategies and risk control. Market watchers note that although overheating risks exist, gold’s defensive appeal is likely to sustain interest.

Still, caution is rising alongside the excitement. Experts warn that while gold is viewed as a safe asset, leveraged and derivative products can amplify losses. Among investors, a familiar phrase is resurfacing: “Survival matters more than profit.” The consensus is growing that disciplined entry, position sizing, and strict risk management must come before chasing returns.

Meanwhile, overseas investor communities are reacting with curiosity, asking half-jokingly, “Are Koreans just really good at trading, like they are at games?” As screenshots of rapid gains circulate globally, Korea is being portrayed as a market where retail traders move fast, adapt quickly, and treat financial markets almost like a competitive online arena.

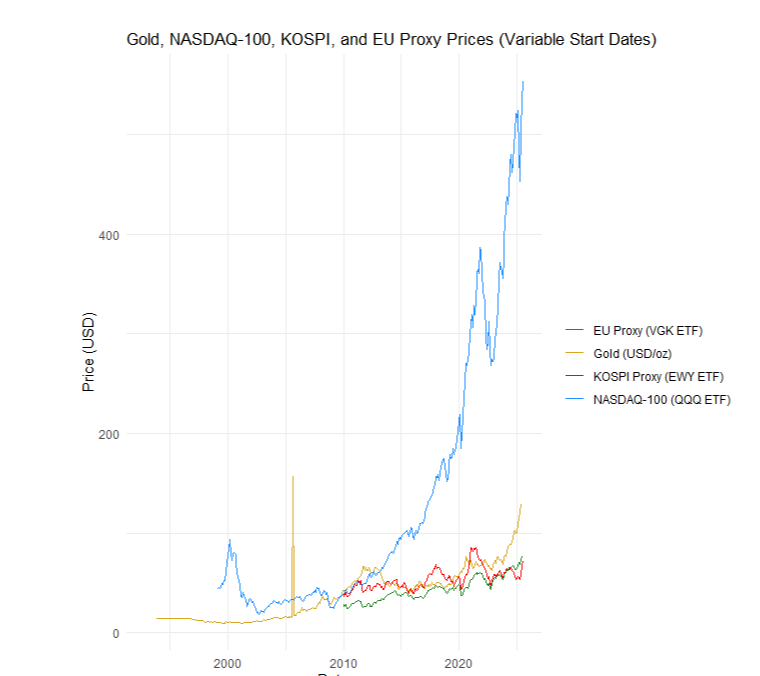

At the same time, a powerful Nasdaq investment wave is unfolding. With U.S. tech stocks drawing strong capital inflows, both gold and Nasdaq continue their upward trajectories, reinforcing the narrative that risk-on momentum and safe-haven demand are rising side by side.

| Year | Nasdaq Composite (Close) | Nasdaq Composite (Annual Return) | Gold (XAU/USD) Annual Return |

|---|---|---|---|

| 2021 | 15,644.97 | +21.39% | -3.65% |

| 2022 | 10,466.48 | -33.10% | -0.31% |

| 2023 | 15,011.35 | +43.42% | +13.09% |

| 2024 | 19,310.79 | +28.64% | +27.11% |

| 2025 | 23,241.99 | +20.36% | +64.29% |

Do NOT miss this — Enter the official partner code

To receive equal benefits and ensure your account is properly linked, the code below must be entered during registration.

Must-know: Do not miss this. Please make sure to enter the partner code BONUSD7. This is how you qualify for $3 cashback per lot, tight spreads, fast deposits/withdrawals, and an unlimited deposit bonus. Enter the official code to get differentiated benefits.

- Cashback $3 per lot

- Costs Tight spreads

- Speed Fast deposits & withdrawals

- Bonus Unlimited deposit bonus

Korea’s Investors Are Watching This Closely

As more Korean traders look for a broker they can actually rely on, benefits like a $100 bonus and one of the fastest support experiences are becoming hard to ignore.

If you want the same level of benefits that many Korean users are aiming for—bonus perks, speed, and smooth assistance— click the link below to get started.

Final Thoughts — Start Small, Stay Consistent

If you’ve been watching the market from the sidelines, this is a great time to start trading step by step. You can begin for free, and even if a welcome bonus isn’t available, you can still build real skill through demo trading. What matters most is staying curious about the economy—and showing up consistently.

Korean traders don’t succeed simply because “they’re good at games.” The real reason is much more practical: they track key headlines, learn the flow, and then take action in the market.

- Habit Check major macro/market news daily (rates, inflation, earnings, global events).

- Practice Use demo trading to test strategies without emotional pressure.

- Execution Start small, manage risk, and build consistency over time.

And here’s the part that boosts motivation: if you generate profit using a free welcome bonus, same-day withdrawals may be possible depending on the platform’s policy. That kind of “real feedback” can be a strong push— but remember, discipline and risk control come first.

Trading is not about one lucky shot. It’s about learning the game of economics, reading the news, and making decisions with a clear plan. If you’re ready, start today—slowly, smartly, and consistently.