The yield curve, a powerful economic indicator, has been a closely watched metric by investors and financial analysts alike. A recent shift in the interest rates has sparked a significant change in the curve, signaling a potential shift in the economy.

Understanding the yield curve can provide investors with a reliable “investment bag” – a set of strategies that consistently deliver returns across different economic conditions. By grasping the relationship between the yield curve and the broader economy, both professional traders and individual investors can make informed decisions in the bond market.

Key Takeaways

- The yield curve is a crucial economic indicator that influences investment decisions.

- Understanding the yield curve can help investors develop reliable investment strategies.

- The yield curve is closely related to interest rates and the overall economy.

- Interpreting the yield curve can aid in making informed decisions in the bond market.

- A comprehensive understanding of the yield curve is essential for both novice and experienced investors.

Understanding the Basics of Yield Curves

A yield curve represents the relationship between bond yields and their respective maturity dates, serving as a vital economic indicator. It is a graphical representation showing the relationship between interest rates and the time to maturity for bonds of the same credit quality.

What Is a Yield Curve and Why It Matters

A yield curve is a line that plots the yields or interest rates of bonds that have equal credit quality but different maturity dates. The slope of the yield curve predicts the direction of interest rates and the economic expansion or contraction that could result. The yield curve serves as a benchmark for other debts in the market, including mortgage rates and bank lending rates, making it a crucial economic indicator.

The U.S. Treasury yield curve is considered the benchmark “risk-free” curve against which other bonds are measured. It is published on the U.S. Department of the Treasury’s website each trading day, providing investors with vital information about the economy.

The Three Main Types of Yield Curves

Yield curves have three main shapes: normal upward-sloping, inverted downward-sloping, and flat. A normal yield curve is upward-sloping, indicating that long-term bonds have higher yields than short-term bonds, typically signifying economic expansion. An inverted yield curve is downward-sloping, suggesting that short-term bonds have higher yields than long-term bonds, often signaling potential recession. A flat yield curve indicates that yields are nearly equal across different maturities, suggesting market uncertainty.

Understanding the yield curve and its types is essential for investors to make informed decisions. The relationship between bond prices and yields is inverse; when bond prices rise, yields fall, and vice versa. This inverse relationship is critical for investors to understand, as it affects the value of their bond holdings.

The Treasury Market, Yield Curve, and Bond Trader Strategy Explained

The Treasury market plays a pivotal role in the global financial system, serving as the foundation for all other fixed-income markets. Its influence on the yield curve is paramount, as it reflects the relationship between interest rates and the maturities of U.S. Treasury securities.

How the Treasury Market Forms the Benchmark

The Treasury market is the largest and most liquid fixed-income market globally, making it the benchmark against which all other bonds are priced. Its size and liquidity provide a reliable indicator of market sentiment, influencing everything from mortgage rates to corporate borrowing costs. The yield curve derived from Treasury securities is closely watched by investors and traders to gauge economic conditions and make informed investment decisions.

Reading Yield Curves Like a Professional Trader

Professional bond traders analyze the yield curve to identify trading opportunities by focusing on its shape, steepness, and changes over time. They interpret different segments of the yield curve—short, intermediate, and long-term—to make strategic trading decisions. For instance, a steepening yield curve might indicate expectations of economic growth, while a flattening curve could signal a slowdown.

Key Components of Successful Bond Trading Strategies

Successful bond trading strategies rely on several key components, including duration management, sector allocation, and credit analysis. Duration management involves adjusting the portfolio’s sensitivity to interest rate changes, while sector allocation requires selecting the right mix of government and corporate bonds. Credit analysis is crucial for assessing the creditworthiness of bond issuers, helping traders mitigate potential risks.

How Yield Curves Predict Economic Conditions

The yield curve is a crucial indicator of economic conditions, providing insights into future growth or recession. It reflects the relationship between bond yields and their respective maturities, serving as a barometer for economic health.

Normal Yield Curves and Economic Expansion

A normal yield curve is characterized by an upward slope, indicating that bonds with longer maturities have higher yields than those with shorter maturities. This shape is typically associated with periods of economic expansion, as investors expect higher returns for committing their capital over longer periods. A normal yield curve suggests that the economy is growing, and investors anticipate higher inflation and interest rates in the future.

Inverted Yield Curves as Recession Indicators

In contrast, an inverted yield curve slopes downward, signaling that short-term interest rates are higher than long-term rates. Historically, an inverted yield curve has been a reliable predictor of economic recessions. This occurs when investors expect economic growth to slow down or contract, leading to lower yields on long-term bonds. The inversion indicates a lack of confidence in the economy’s short-term prospects.

Flat Yield Curves and Market Uncertainty

A flat yield curve occurs when the yields on bonds with different maturities are similar, resulting in a flat shape. This type of curve indicates market uncertainty, as investors are unsure about the future direction of the economy. A flat yield curve often appears during transitional periods, where the economy is moving from growth to recession or vice versa. It reflects a lack of clear expectations about future interest rates and economic growth.

The yield curve’s shape is influenced by various factors, including central bank policy and market expectations. By analyzing the yield curve, investors can gain insights into economic conditions and make informed decisions about their investment strategies.

Building Your Investment Strategy Based on Yield Curve Analysis

Understanding the yield curve is crucial for investors looking to create a tailored investment strategy that meets their financial goals. The yield curve serves as a vital indicator of market expectations for interest rates, inflation, and economic growth.

To develop an effective investment strategy, investors must first determine their interest rate view based on economic indicators, central bank communications, and yield curve analysis.

Determining Your Interest Rate View

Investors should analyze economic indicators such as GDP growth, inflation rates, and unemployment levels to form an opinion on future interest rate movements. Central bank communications and monetary policy decisions also play a crucial role in shaping interest rate expectations. By examining the yield curve, investors can gain insights into market expectations for future interest rates and adjust their investment strategy accordingly.

For instance, a steepening yield curve may indicate expectations of economic growth and rising interest rates, while a flattening yield curve could signal concerns about economic slowdown and lower interest rates.

Positioning Your Portfolio for Different Yield Curve Scenarios

Once investors have formed an interest rate view, they can position their portfolio to maximize returns while managing risk. This involves adjusting the portfolio’s duration and convexity to respond to different yield curve scenarios, such as steepening, flattening, or parallel shifts.

For example, if an investor expects interest rates to rise, they may choose to reduce their portfolio’s duration to minimize potential losses. Conversely, if they anticipate falling interest rates, they may increase duration to capitalize on potential gains.

- Adjusting portfolio duration to match interest rate expectations

- Diversifying investments across different asset classes to manage risk

- Utilizing hedging strategies to mitigate potential losses

Risk Management Techniques for Yield Curve Strategies

Effective risk management is critical when implementing yield curve strategies. Investors can use various techniques, including duration matching, diversification, and hedging, to manage interest rate risk and protect their portfolio’s value.

By understanding the yield curve and employing these risk management techniques, investors can create a robust investment strategy that maximizes returns while minimizing risk.

Advanced Yield Curve Trading Techniques

Advanced yield curve trading techniques offer sophisticated investors a nuanced approach to navigating complex market conditions. These strategies enable traders to capitalize on subtle changes in the yield curve, thereby optimizing their investment returns.

Barbell vs. Bullet Portfolio Strategies

A barbell portfolio, which combines short- and long-term bond positions, offers greater convexity than a bullet portfolio concentrated in a single maturity for a given duration. This makes barbell strategies particularly effective in environments where interest rate volatility is expected to increase. In contrast, bullet strategies focus on a specific maturity point, making them suitable for investors with a clear interest rate view.

Steepener and Flattener Trades

Steepener trades involve betting on an increasing spread between short- and long-term rates by combining a “long” short-dated bond position with a “short” long-dated bond position. Conversely, flattener trades bet on a decreasing spread by selling short-term bonds and purchasing long-term bonds. These strategies are crucial for investors seeking to capitalize on yield curve dynamics.

Butterfly Strategies for Yield Curve Shape Changes

The butterfly strategy involves combining a long bullet with a short barbell portfolio (or vice versa) to capitalize on expected changes in the yield curve’s curvature, particularly in the intermediate segment. This strategy allows traders to profit from yield curve shape changes, making it a valuable tool in their investment arsenal.

Professional traders often use derivatives like futures, options, and swaps to implement these advanced yield curve strategies with greater capital efficiency. By adapting these techniques to different market conditions and investor risk tolerances, traders can optimize their investment strategies. Historical case studies have demonstrated the successful application of these strategies in various market environments, underscoring their utility in yield curve trading.

Practical Tools and Resources for Yield Curve Analysis

The yield curve is a vital indicator for investors, and understanding its dynamics requires access to reliable data and analysis tools. To make informed investment decisions, it’s crucial to have the right resources at your disposal.

Essential Data Sources for Tracking Yield Curves

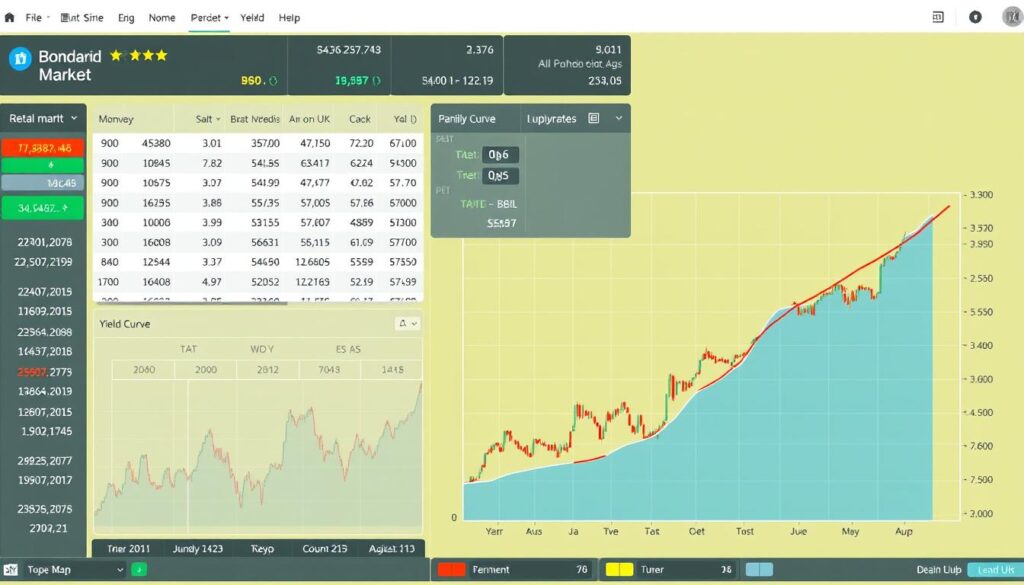

To track yield curves effectively, investors need access to real-time data. Government websites, such as the Treasury’s interest rate website, provide yield curve rates by 6:00 p.m. ET each trading day. For a more visual representation, investors can use tools like Excel spreadsheets to build their own yield curve charts. Additionally, financial news platforms and specialized financial data providers offer comprehensive yield curve data and analysis. For more information on how yield curves work, you can visit this resource.

Software and Platforms for Bond Market Analysis

Various software and platforms cater to bond market analysis, ranging from basic tools for individual investors to sophisticated systems used by institutional traders. These platforms provide real-time market data, enabling investors to monitor changes in the yield curve and adjust their strategies accordingly. When selecting a platform, consider the type of analysis you need and the level of detail required for your investment decisions.

Conclusion: Creating Your Own Reliable Investment “Bag”

Through the lens of yield curve analysis, investors can gain a deeper understanding of the economy and make more strategic investment choices. By understanding the yield curve and its implications, investors can develop a personalized investment “bag” tailored to their risk tolerance, investment goals, and market outlook.

The key insights from this article emphasize how yield curve analysis provides a reliable foundation for fixed-income investment strategies. It is crucial to continuously learn and adapt as market conditions and yield curves change over time. Combining yield curve analysis with other investment approaches can create a more robust overall strategy.

While yield curves are powerful predictive tools, they should be part of a broader investment framework that considers multiple factors, including interest rates, inflation, and government policy. To begin implementing yield curve analysis, investors can start by tracking yield curve changes and adjusting their portfolios accordingly.

Successful investing is a marathon, not a sprint, and developing expertise in yield curve analysis takes time and practice. As financial markets continue to evolve, yield curve analysis will remain a relevant and valuable tool for investors. By incorporating these insights into their investment strategies, investors can build a more resilient and effective portfolio.